3 villains can steal your retirement dreams

Building a strong financial castle to fund your retirement is hard. If

you're not careful, you may discover a hole in your vault and three

villains sneaking off with the family jewels.

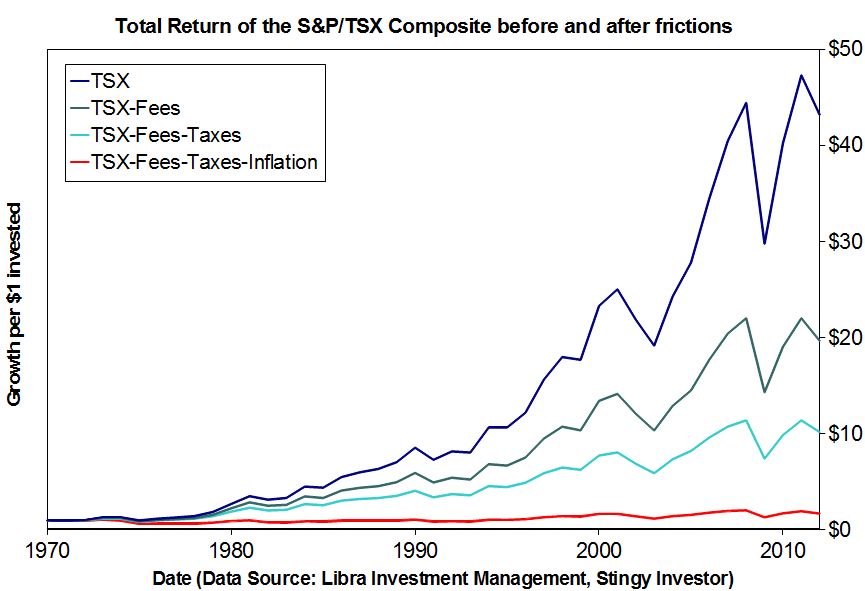

To see these predators in action, let's begin by considering a

portfolio that follows the total return of the S&P/TSX Composite index

as shown in the following graph. The index has performed well since 1970 with

an average annual return of 9.4 per cent.

[larger version]

But these happy returns don't factor in the annual fees charged by

funds. These typically range between 2 per cent and 2.5 per cent for

Canadian stock funds and are called management expense ratios (MERs).

Problem is, funds - on average - have a hard time beating the index's

returns before fees. They tend to trail badly after fees. Indeed,

there are theoretical reasons to think that funds, as a group, merely

yield index returns less the fees they charge.

The fee line on the graph is based on the uncharitable view that funds

achieve index returns minus a 2 per cent annual fee. Over the period,

those seemingly small charges reduce the size of the ending portfolio

by more than 50 per cent. Such is the misery of compounded fees.

Fund fees are one thing but the crown also likes to extract a pound of

flesh. The third line on the graph - the one just under the fee line

- represents the returns of the index after the 2 per cent fund fee

and a 23 per cent tax on gains from the prior peak levied annually.

The point here isn't one of precision - after all, different investors

are subject to different tax burdens - but to highlight why proper tax

planning is important. Stingy investors want to legally reduce taxes

and fees, all else being equal.

Inflation is the third sapper of wealth and the last line on the graph

shows the combined impact of 2 per cent annual fees, 23 per cent

annual taxes on gains, and inflation.

The result? The 9.4 per cent starting annual return for the index is

reduced to a mere 1.3 per cent after fees, taxes, and inflation are

taken into account. Put in dollar terms, instead of growing each

dollar invested to $43.20 over the period, you'd only be left with

$1.70 after fees, taxes, and inflation.

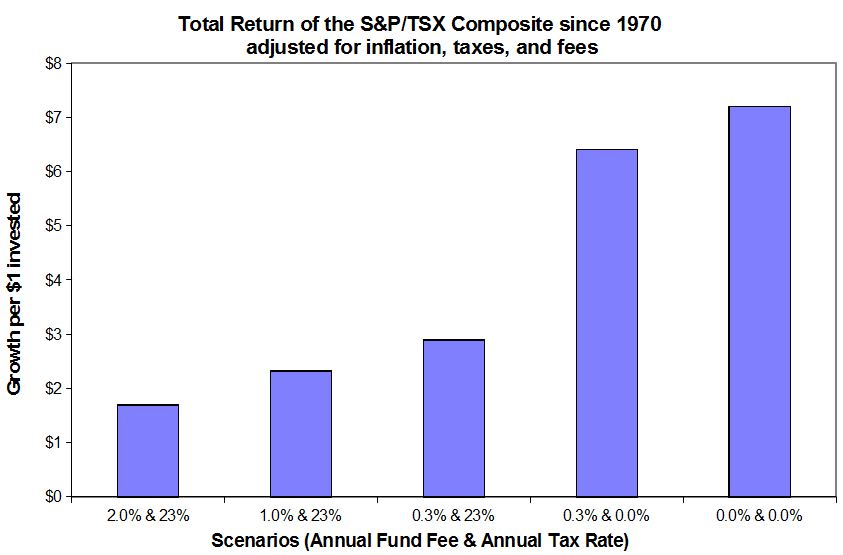

But you can foil two of the villains. Fund fees can be reduced by

favouring low-fee active funds or lower-fee index funds and

exchange-traded funds. On the tax front, you can save via TFSAs or

defer taxes by using RRSPs or opting for longer holding periods.

The bar chart shows several different low-fee and low-tax

scenarios. For instance, a 0.3 per cent annual fund fee and a zero tax

rate would have put $6.40 in your pocket, adjusted for inflation, per

dollar invested. That's a darn sight better than $1.70.

[larger version]

The moral of the story? Be sure to keep a close eye on fees and

taxes. If you don't, a pack of villains might run off with the bulk of

your retirement portfolio.

First published in the Globe and Mail, January 28 2012.

|

|