|

|||||

|

|||||

|

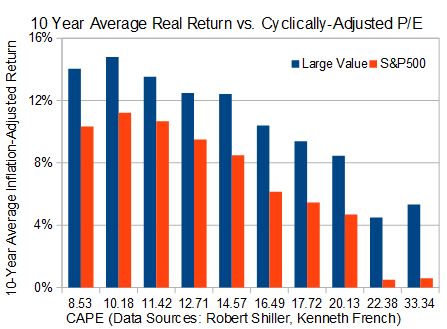

Value vs CAPE Stock markets have been lurching downward since the re-election of U.S. President Barack Obama. Should you consider that a signal to trim your stock holdings? The answer may depend on what type of investor you are. By at least one important yardstick, the market is overvalued and likely to produce lacklustre returns. But value investors have a better chance than most to produce respectable results. The yardstick that I often use to measure the market's value is the cyclically adjusted price-to-earnings ratio (CAPE) developed by Robert Shiller of Yale University. It compares the stock market's price with its average real earnings over the past 10 years - roughly the length of a business cycle. While it isn't a perfect guide, CAPE has some power to predict what returns the market will produce over the long term. It's not clear, however, that Prof. Shiller's ratio for the overall market is useful to those who invest at the value end of the spectrum. After all, most value investors stick to buying stocks deep in the bargain bin. As a result, their portfolios usually have little in common with the market indexes such as the S&P 500. To probe what value investors can reasonably expect, it's interesting to look at how value stocks tend to do at various levels of market valuation. Kenneth French, a professor at Dartmouth University, has compiled return data based on size and price-to-book-value. This allows us to focus on the large value slice of the U.S. market. Such stocks have market capitalizations (a measure of size) that are above the median. They are also in the lowest 30 per cent of the market in terms of their prices in comparison to their book values (a measure of value). In one study, Prof. French screened for large value stocks each year, held equal proportions of them for 12 months, sold, and then repeated the process. As a result, he built up a long-term performance record that can be combined with Prof. Shiller's data going back to the middle of 1926. From there, it's an easy matter to calculate 10-year inflation-adjusted returns starting from different CAPEs each month. The observations are sorted into 10 equal groups by CAPE, called deciles, and the average for each group determined. That might sound complicated, but the results are easy to understand. You can see them in the accompanying graph, which shows how average annual 10-year real returns vary by CAPE for both the S&P 500 and large U.S. value stocks.

For indexers, it is clear that high CAPE ratios are toxic to real returns. That is bad news because the S&P 500's ratios have been sky-high for much of the past 20 years. After the recent decline, the ratio is sitting at 19.9, right in the middle of the eight decile. If history holds, index investors might expect real returns near 4.7 per cent over the next 10 years. That is a pretty good return, especially in comparison to today's paltry bond yields, but it's far short of what many investors appear to expect. Can value stocks do any better? Our graph shows that large value stocks are no panacea. They, too, return less when starting from periods with high market CAPEs. But the good news is that large value stocks did better than the market from all starting CAPE deciles and fared reasonably well even when the market was pricey. They enjoyed real 10-year average annual returns near 5 per cent starting from periods when the market P/E was in the top two deciles. They also posted annual gains near 8.5 per cent from current levels. Mind you, there are no guarantees. Despite the precision implied in the graph, history shows real returns vary widely within each decile. So you can't count on an 8.5-per-cent return - all you can say with some confidence is that large value stocks have a strong tendency to do better than the overall market over the long term. I must admit to being somewhat pessimistic about the prospects for value stocks - and the market - at the moment. So while I would be overjoyed to see value portfolios generate 8-per-cent-plus real returns over the next 10 years, I think it's prudent to plan for rather less generous results. First published in the Globe and Mail, November 14 2012. |

|||||

| |||||

| Disclaimers: Consult with a qualified investment adviser before trading. Past performance is a poor indicator of future performance. The information on this site, and in its related newsletters, is not intended to be, nor does it constitute, financial advice or recommendations. The information on this site is in no way guaranteed for completeness, accuracy or in any other way. More... | |||||