The surprisingly strong case for index roulette

The financial life of a prudent index investor is purposefully

dull. You know the routine. Pick a balanced portfolio of basic low-fee

funds and ETFs, rebalance occasionally, and hope to wake up

comfortably rich one day.

Where's the spark in that? Where's the pizzazz? Where are the piles of

doubloons? To become stinking rich, you have to strap on the six

shooters and shoot for higher targets.

Cue the normal caveats: This ratchets up your risk. It is not for

everyone. It could leave you poor.

But that being said, let's take a look at a risky but potentially

profitable way to amp up the returns from index investing.

Instead of spreading your bets around, we'll examine what would have

happened over the past four decades if you had used momentum trends to

pick where to invest among six basic asset classes: three-month

Canadian treasury bills, long-term Canadian bonds, the S&P/TSX

composite, the S&P 500, international stocks (via the EAFE index), and

gold.

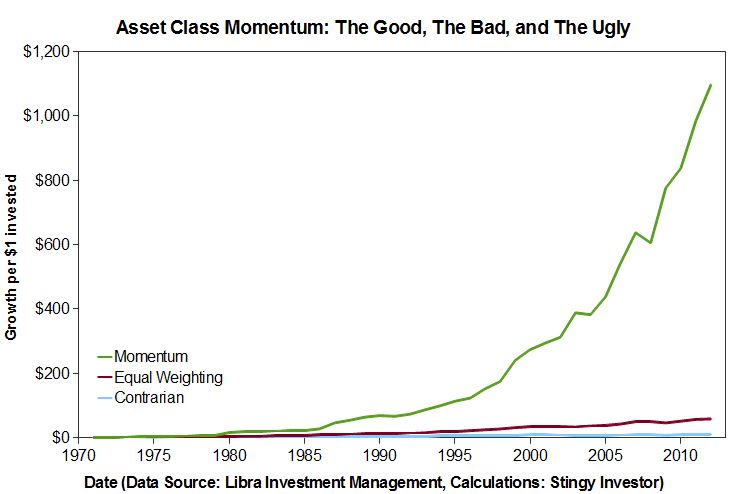

A sensible investor who invested equal parts of their portfolio in

each asset would have netted a handy average annual return of 10.4 per

cent since 1971. But those with more derring-do might have opted to

buy the asset class that had fared the best over the prior year. Those

brave souls would have nabbed an 18.6-per-cent average annual return.

On the other hand, contrarian investors, who bought into whatever

happened to be the worst class over the prior year, would be crying in

the poor house with returns of only 5.7 per cent a year. The path

taken by each of these investors is displayed in the accompanying

graph. (It shows results in Canadian dollars before fees are

subtracted and assumes annual rebalancing.)

[larger version]

Rather surprisingly, momentum still wins by a mile even if you exclude

any one of the six asset classes from the mix. (Mind you, ignoring

gold reduces overall returns rather substantially because gold saw

some very nice runs in the 1970s and 2000s.)

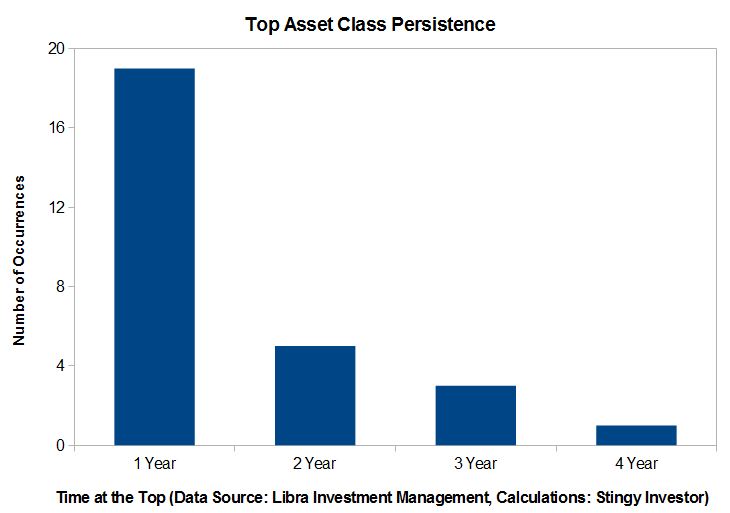

The time spent at the top of the heap is shown in the accompanying

bar chart. As you might expect, the top-performing asset class was

most often dethroned by a new one after only one year. Such periods

are collected up into the one-year category. It's the relatively high

number of two-, three-, and four-year streaks that make the momentum

strategy shine. They put momentum investors in the best asset class

about 34 per cent of the time. Even better, the largest down period

for momentum was a decline of only 5.6 per cent back in the early

1980s when it erred by moving into the S&P 500.

[larger version]

So should you unleash your inner Yosemite Sam and try to reach for

better returns using a concentrated momentum approach? It's hard to

endorse such a scheme because these methods tend to eventually blow up

like old barrels of TNT. But if you want to lean a bit in this

direction, a little birdie told me that long bonds are the place to be

in 2012.

First published in the Globe and Mail, March 10 2012.

|

|