|

|||||

|

|||||

|

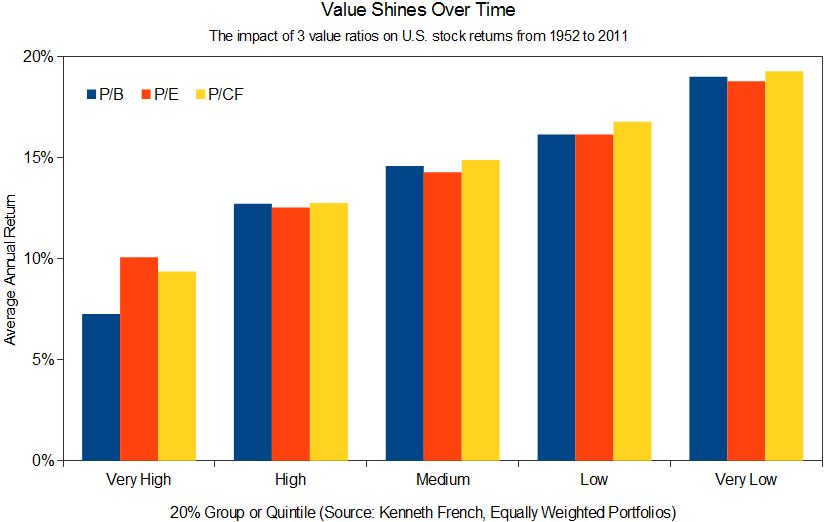

What would Buffett buy? Warren Buffett is one of the best investors of our age and his extraordinary record spans many decades. Such is his renown as both an investor and businessman that even presidents seek his advice on economic matters. But Buffett isn't shy about sharing the factors behind his investment success. While it's true he hasn't detailed his approach in a book of his own - many other authors have attempted to do so on his behalf - he has gotten close via his many letters to investors that accompany Berkshire Hathaway's annual report each year. Buffett became CEO of Berkshire Hathaway when it was a struggling textile company in the mid-1960s. Since then it has become a colossal conglomerate with large insurance and stock holdings. After obtaining control, Buffett grew Berkshire Hathaway's book value by an average of 20% a year from 1965 to 2011. That's an astonishingly good record. Buffett has always been a value investor and attributes much of his success to this strategy. What is value investing? It's the practice of buying businesses with high intrinsic values for low prices. Value investors are bargain hunters. They tend to avoid hot stocks and instead load up on dull, even hated names that are on sale. Later I'll share the names of 20 stocks Buffett might be interested in, but first let's take a closer look at the types of strategies he's become known for. There are many flavours of value investing and its practitioners specialize in a variety of niches. After all, good values can be found in many nooks and crannies. For instance, some like to buy high-quality assets at moderate prices. Others specialize in weak and struggling firms at lower prices. A few are financial scrap dealers who trade the securities of distressed or bankrupt companies. Those who follow Buffett know his value style has evolved over time. He started his career looking for lesser-known companies trading at bargain prices, but more recently has favoured larger, higher quality names at reasonable prices. The change was necessary because he now manages many billions of dollars at Berkshire Hathaway: buying small firms just doesn't make much difference to his overall results anymore. Most will find Buffett's original style easier to master. In the early days he employed more common value investing methods, whereas he currently factors in the qualitative features of a business more heavily. It also helps that Buffett's early career was highly influenced by his teacher and mentor of whom we know a great deal. Buffett finished his education at the Columbia Business School in New York because he wanted to take classes from Benjamin Graham. At the time Graham was already a famous investor in his own right. He was also an influential professor, and many of his students subsequently went on to become great investors themselves. Graham's record was impressive. He ran an investment partnership with Jerome Newman that provided average annual returns of nearly 15% after fees from 1934 until it was wrapped up in 1956. Over the period Graham bested the markets by 2.5 percentage points a year on average, after fees. Even though Graham passed away in 1976, he remains a giant in the field and, in some ways, is more influential than Buffett. Graham's books, The Intelligent Investor and Security Analysis, are still in print and occupy a treasured place on the bookshelves of professional investors worldwide. Mind you, it's also fair to say Buffett has outpaced his teacher's record, both as an investor and as a businessman. Importantly, Graham provided investors with concrete guidance and several easy-to-use rules of thumb in his books and other writings. His methods have remained remarkably effective through the years and have a place in the toolbox of most value investors to this day. I've personally used them for a long time to very good effect. How to find value stocks The main problem with value investing - and much of investing in general - is figuring out how much a company should be worth, independent of its current market price. There are many ways you can go about doing it, but they are all approximations. For instance, analysts often create huge spreadsheets with earnings projections going out many years. Then they perform fancy calculations to determine a company's worth. Problem is, even small changes in assumptions can cause large differences in their output, so the usefulness of such calculations is limited. Value investors, on the other hand, tend to distrust long-term projections and prefer to focus on hard assets. They want to know what a business is worth based on current circumstances using conservative estimates. The grand hopes of what tomorrow might bring don't factor into it. On this front, Graham espoused a particularly severe method during the Great Depression of the 1930s. He looked for profitable firms trading at much less than their current assets (cash and assets that can be turned into cash over the next year) minus all liabilities. In general, he bought businesses for much less than the value that could be realized by liquidating them. He called such firms 'Net-Nets.' As he wrote in Forbes, he thought these firms were better off dead than alive from the viewpoint of shareholders. It was easy to buy Net-Nets during the dark times of the 1930s. Prices were very low because a generation of investors had fled the markets, never to return. As is usually the case, horrible times produce bountiful bargains. Problem is, in more buoyant eras these bargains disappear. It is easy to go for long periods without spotting more than a few large stocks that qualify as Net-Nets. But they do resurface after crashes: for instance, a good number of them could be found during the panic of 2008-09. Enterprising investors can still find a few in Japan and Europe. More practically, many value investors take a step back from such parsimonious measures of value and instead focus on a company's book value. You can calculate book value by subtracting a firm's liabilities from its assets. It isn't a perfect measure, and I'll mention some of its flaws in a moment, but book value turns out to be a reasonable place to start. As you might expect, value investors want to buy lots of book value for a low price, all else being equal. In other words, they like stocks with low price-to-book-value ratios (P/B). Graham himself suggested defensive investors should stick to stocks with price-to-book-value ratios of 1.5 or less, although he was willing to consider stocks with slightly higher ratios from time to time. Smart investors are sure to take a more detailed look at each firm's balance sheet before calculating its P/B. They want to spot assets that might be worth more or less than stated on the books. For instance, real estate purchased many years ago may well be worth a great deal more than stated on a firm's balance sheet. Conversely, stale inventory might not be worth as much as expected and the firm may only be able to sell it at a sharp discount. Despite its flaws, opting for stocks with low P/B ratios has been surprisingly effective over the very long term. Academics now routinely use the ratio (or more technically its inverse, the book-to-market ratio) as a primary factor when gauging the markets. For a look at the long-term usefulness of P/B ratios I turn to the work of Kenneth French, finance professor at Dartmouth College in New Hampshire, who studies their merits. In one study he sorts U.S. stocks by P/B, divides them into five equal groups called quintiles, and follows the performance of each group for a year. He then repeats the process over many years to calculate return figures. Just as Graham would have predicted, the low-P/B groups have done very well indeed. From 1952 to the end of 2011 the lowest P/B quintile gained 19% a year on average, whereas stocks with the highest 20% of ratios trailed badly with gains of only 7.3% a year. Beyond the book But P/B is only one of many ratios value investors like to follow. Similarly good results can be obtained by opting for stocks trading at low prices in relation to other measures of financial merit. The most popular valuation ratio, and one that Graham was fond of, is the ubiquitous price-to-earnings ratio (P/E). Simply put, value investors want to buy lots of earnings for a low price, all else being equal. Graham helpfully provided a rule of thumb: he thought defensive investors should look for stocks with price-to-earnings ratios of 15 or less. As it happens, French also studied the performance of stocks based on P/E. From 1952 to the end of 2011, he showed that the 20% of stocks with the lowest P/E ratios yielded average annual returns of 18.8%, whereas those in the highest ratio group only provided 10.1% returns. The fact that low-P/E and low-P/B stocks continued to outperform after Graham's death may be surprising. After all, the world has witnessed a great deal of technological innovation since 1976. It has also seen large social, economic, and political changes during the period that includes the collapse of the Soviet Union and the reemergence of China as an economic power. The staying power of value investing has been strong despite the changing times. Another popular factor to study is cash flow. Roughly speaking, this is the amount of cold hard cash a company sees coming in the door. It's a slightly different, and in some ways more conservative, measure than earnings, making it well worth checking out. It also inspires investors to look at price-to-cash-flow ratios (P/CF). How do P/CF ratios stack up against the other ratios we've discussed? Once again, French's data provides the results. From 1952 to the end of 2011 the 20% of stocks with the lowest P/CF ratios posted 19.3% average annual returns, while those in the highest ratio group picked up 9.4% a year on average. The return pattern is striking whether you use P/B, P/E, or P/CF. Low ratios yield good results, while high ratios lag. You can see the consistency of this pattern in following graph. It highlights the average annual return provided by each quintile (20% group) based on each ratio from 1952 to 2011. You.ll notice the returns are only marginally different in most cases. However, when it comes to very high ratio stocks, high-P/B ratios have proven to be lacklustre.  [Click for larger version] Many value investors like to further refine these basics. For instance, some opt to use tangible book value, because this ratio focuses on hard assets and ignores goodwill and other intangibles. It is a more conservative measure than plain old book value. Similarly, deciding the type of earnings to use when calculating P/E is a matter of taste. For instance, French uses earnings over the prior year (also referred to as trailing 12-month earnings), which is very common. But some investors also like earnings before exceptional items, while others favour expected earnings to calculate forward P/E ratios. Free cash flow is a common alternative to regular cash flow. It measures how much cash a company generates after capital expenditures. More subtly, Buffett likes a slightly different measure he calls 'owner earnings.' It's like free cash flow, but is calculated by starting with cash flow and subtracting the money needed to maintain the business. It's an indicator of how much money the owners could extract from the business without shrinking it. Improve your margin of safety Aside from price ratios, wise investors like Graham move beyond value ratios and look for additional measures of safety. After all, the ratios of critically ill firms often fall to tiny levels as they slip into bankruptcy. It's a good idea to avoid such situations unless you specialize in bankruptcies. You could consider a nearly endless list of warning signs. But some red flags are easy to spot and don't require an advanced accounting degree. Perhaps the most important safety factor is profitability. After all, truly profitable firms rarely go under unless they are hit by a sudden calamity. Instead, firms get into real trouble by losing money over long periods. As a result, gravitating to profitable companies represents a good first step to a safer portfolio. Similarly, a firm's earnings should be backed up by its cash flows. A positive cash flow is a good thing, but cash flows should generally exceed earnings. If they don't, more scrutiny is advisable because the company may be using overly aggressive accounting. There are also various trends you can keep an eye on. Has the company been growing its earnings at a reasonable rate? Has earnings growth translated into dividend growth? Is the firm using excess cash to pay down debt or buy back its own shares at reasonable prices? The basic question is whether a company is improving, stable, or deteriorating. Those in the latter category pose extra risks and deserve extra caution. Mind you, supercharged growth can also be risky, depending on the situation. A question of quality Buffett likes to use the concept of a moat to describe the quality of a company and its ability to defend itself from other businesses. There are many types of moats, but they all represent some form of competitive advantage that is hard to challenge. For instance, a company with a patent on a drug has been granted a temporary monopoly. Other drug companies can't sell the drug until the patent expires unless they obtain permission from the patent holder. As a result, the patent holder has a wide but temporary moat. Firms can also have smaller moats based on branding, a long history of customer satisfaction, a good distribution network, or some other factor. It's all about achieving, maintaining, and hopefully growing a competitive edge. On the other hand, a large number of businesses have tiny moats that are easily crossed by competitors. Commodity producers tend to be in just such a pickle. The consumer doesn't care about getting brand X or brand Y because the products are basically indistinguishable. Such firms are forced to compete on price. How do you tell if a company has a moat? As with many other things, Buffett has an apt way of cutting to the chase. He says companies that can set and raise the price of their products without holding many meetings or studies are likely have a moat of some sort. Firms with large moats are safer bets, all else being equal. I'll search for just such stocks in a bit. A look at the downside Before hunting for a few good stocks, I want to talk about what might go wrong. After all, to this point I've told you about the upside of value investing, but I've not mentioned much about the potential downside. Problem is, as Buffett says, 'investing is simple, but not easy.' Stocks get cheap for a reason, and that reason is often based on very real fears. For instance, try to remember what it felt like back in the spring of 2009. The financial world was in a shambles and governments were belatedly trying to patch the economy together by throwing huge wads of cash at it. Nothing seemed to work and markets continued to slide. At the time, stocks seemed poised to fall much further. Buying in early 2009 was far easier said than done. But value investors try to buy at exactly such times. They seek out panics and disasters wherever they can be found: be they in the markets overall, in particular industries, or in individual stocks. It's an approach that can be difficult to implement and can result in sleepless nights. Many investors are simply not up to the challenge in practice. Value investing can be a hard road to travel. Even worse, those rosy looking long-term performance figures I highlighted earlier obscure a few less than rosy short-term periods. If you're a value investor, you will eventually encounter some truly horrible down periods. The crash of 2008 provides an illuminating example. If you look at French's monthly data on the 20% of stocks with lowest P/B ratios, you'll find they fell about 66% from the summer of 2007 to the lows of early 2009. The magnitude of that decline really jumps out when you put it in dollar terms. If you started with a $500,000 portfolio of low-P/B value stocks in the summer of 2007, by the spring of 2009 you would have been left with about $170,000. You would have lost some $330,000. Holding on and buying more after such a beating would have taken a huge amount of willpower and a dollop of pigheadedness. However, buying would have turned out to be the right move because the low-P/B group reversed its losses, shot up, and subsequently exceeded the highs seen in mid-2007. While these huge losses might be a once-in-a-generation affair, big slumps are a feature of the markets. They have to be expected, and value investing provides little in the way of protection. Worse, it can take years - and sometimes decades - for stocks to work their way out of particularly big holes. If market-wide slumps are worrisome, they are nothing compared to the collapses seen with individual companies. Stocks rocket around like out-of-control pinballs compared to the overall markets. As a result, long-time value investors should expect to see at least a few stocks produce disastrous results. Such losses are painful but they go with the territory. I'm not trying to scare you. (Okay, maybe just a little bit.) I do think value investing can be very rewarding over the long term and it is a method I personally follow. However, I like to examine both the upside and downside possibilities of any approach. Looking for moats It's finally time to focus our efforts on a specific value approach that can be used to find good stocks today. To formulate a method I start with a solid Buffett base, then meld in a little frugality from Graham. Starting with safety, I turn to Buffett's love of stocks with large moats. Naturally, everyone has a different definition of what constitutes a good moat. Morningstar.com has a methodology it uses to assign an 'Economic Moat Rating' to U.S. companies. It's a handy place to start. When it comes to moats, only the best will do, so I began with U.S. stocks rated as having wide moats by Morningstar. There are many types of moat on display. Thus, Caterpillar has a good reputation for providing quality products backed by strong dealer support: critically important when downtime is costly. On the other hand, Cisco dominates in network equipment, where it enjoys a technological edge. Many U.S. stocks have wide moats so to narrow the list I added in a little Graham by focusing on the lowest combination of P/E and P/B ratios. Stocks with two absolutely low ratios make the cut but so do some with one low ratio and one slightly higher ratio. In this way I'm opting for a relative rather than an absolute value approach. So while Intel trades at a low P/E of 11, its P/B ratio is a little high at 2.7. But Intel's real worth is primarily a function of its intellectual property, which forms the foundation for its moat. The least-expensive wide-moat stocks get a spot in the Bargain stocks Buffett might buy portfolio, shown in the following table. Buffett's own Berkshire Hathaway currently passes the test, which shouldn't surprise his fans: Buffett has been adding wide-moat companies for years. His firm recently announced it will buy back its stock when it trades under 1.1 times book value. It currently trades just a bit higher at 1.2 times book value, which is still quite attractive. Will these stocks live up to the reputations of the masters? Only time will tell but I have high hopes. This list is only a starting point for serious investigation. Before buying any of these stocks, make sure the company's situation hasn't changed in some important way. Read the latest press releases, regulatory filings and news more broadly. Poke and prod each stock closely. Is its moat being eroded by new technology? Is it making unwise acquisitions? Are there problems not readily apparent in the numbers? Be sure to do your own due diligence before heading to the market. The List Bargain Stocks That Buffett Might Buy [.xls] Value picks books list Warren Buffett's annual letter to shareholders is eagerly awaited by thousands of investors each spring. You can read all of them going back to 1977, for free, at berkshirehathaway.com. Much of Buffett's wisdom has also been collected in The Essays of Warren Buffett: Lessons for Corporate America, edited by Lawrence A. Cunningham, published in 2008. Additional information on Buffett and his techniques can be found in his biographies. Alice Schroeder's The Snowball is a good place to start, but don't forget Damn Right by Janet Lowe, which chronicles the life and times of Buffett's long-time business partner Charlie Munger. Here are some other great resources for value investors who want to learn more: Contrarian Investment Strategies, by David Dreman. An accessible take on value investing and the markets from a famous fund manager and long-time Forbes columnist. Get the new edition published earlier this year. Value Investing by James Montier. A modern view of value investing presented in handy chunks that are suitable for reading over coffee. The book is geared to practicing value investors and Montier's Little Book of Behavioral Investing is better for new investors. The Intelligent Investor by Benjamin Graham. A good first book provided you don't mind Graham's archaic writing style. Look for the revised edition (Harper Business, 2003), which includes modern commentary by personal finance columnist Jason Zweig. Security Analysis, by Benjamin Graham and David Dodd. This is the bible of value investing. It's highly informative and well worth reading, but it is also heavy for those just starting out. + First Published: MoneySense magazine, September 2012 |

|||||

| |||||

| Disclaimers: Consult with a qualified investment adviser before trading. Past performance is a poor indicator of future performance. The information on this site, and in its related newsletters, is not intended to be, nor does it constitute, financial advice or recommendations. The information on this site is in no way guaranteed for completeness, accuracy or in any other way. More... | |||||