Can Fairfax's bear market strategy work for you?

Prem Watsa is worried about the stock market. In fact, the famed value

investor and CEO of Fairfax Financial has hedged his company's stock

portfolio against a market downturn.

When an investor as successful as Mr. Watsa adopts such cautious

measures, should ordinary investors follow his lead? Let's take a look

to see if investing in value stocks while selling, or 'shorting,' the

broad market has worked - either as a permanent technique or as a

temporary measure when the markets are due for a decline.

To hedge its portfolio against the possibility of a bear market,

Fairfax takes out short positions against the S&P500 and Russell 2000,

selling the broad market indexes so the company will benefit if they

decline.

Although the hedge is of the same size as Fairfax's stock portfolio,

it does not specifically cover the value stocks that Mr. Watsa owns

(or as the pros say, is 'long' in). As a result, it is not an exact

hedge. There is a slight mismatch.

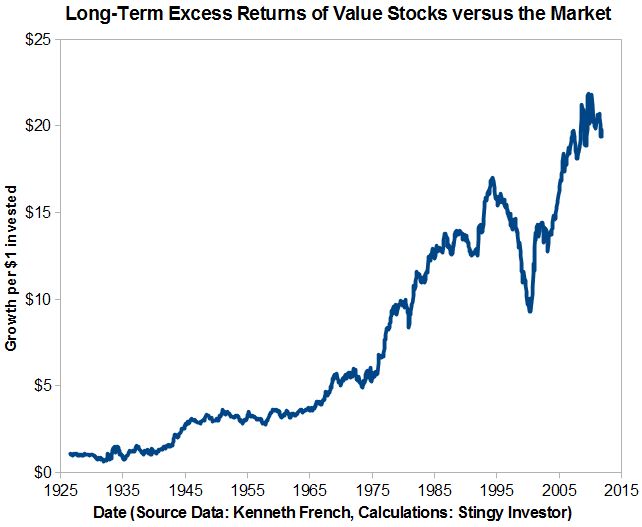

The accompanying graph gives some idea of how a similar long-short

strategy might work. It shows the returns that come from going long in

value stocks and shorting the broad U.S. stock market.

[larger version]

The value side of the equation is represented by the returns of the

second lowest 10 per cent (or decile) of stocks in terms of

price-to-book-value (P/B). Stocks with low P/B ratios are considered

classic value stocks. The second lowest P/B slice also happens to be

the top performing decile over the long-term.

The market is represented by the returns of the largest 30 per cent of

stocks by market capitalization. This approximates the S&P 500.

The data show that value stocks have outperformed over the long

term. A simple strategy of investing in value stocks would have

provided 12.4 per cent average annual returns.

Sticking to a hedging strategy through thick and thin would have hurt

your results. Going long value stocks while shorting the market

yielded only 3.5 per cent average annual returns.

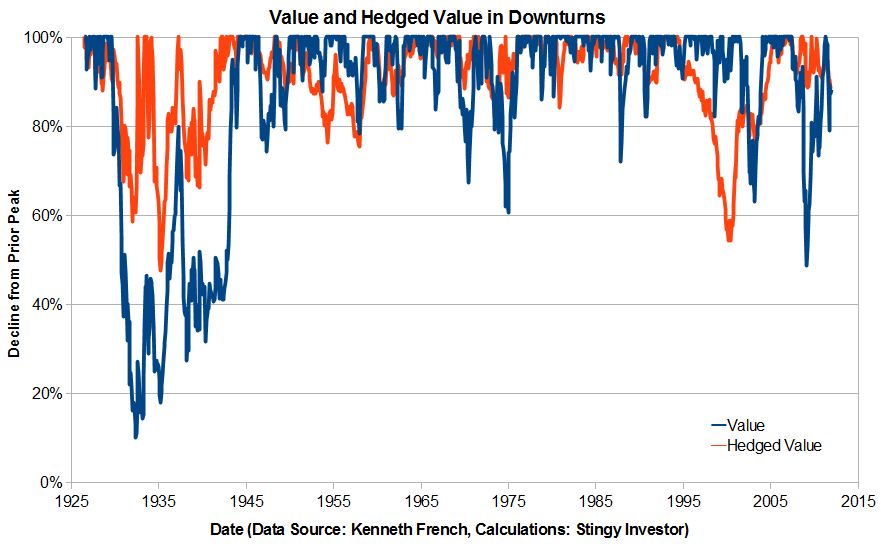

But can shorting the market at least help protect your wealth in

downturns? The second graph addresses that question. It shows periods

when the long-short portfolio declined from its prior peak in

comparison to similar periods for buy-and-hold value investors.

[larger version]

The numbers say the long-short strategy did provide some protection

against the big value crashes of the past. Most notably it muted the

crash of 1929. It would have also helped during the 2008 debacle.

However, it isn't a surefire technique because it still suffered a 50

per cent decline in the 1930s. As a result, most investors should

probably avoid complicated hedging strategies and simply hide out in

cash during such periods. To make a shorting strategy pay off, you

have to be able to spot bear markets ahead of time. As a Fairfax

shareholder, I hope that Mr. Watsa's crystal ball has maintained its

clarity.

First published in the Globe and Mail, May 5 2012.

|

|