A time-honoured investing theory collides with new facts

Everyone agrees that investing strategies should be based on long-term

evidence, not just a year or two of results.

Here's the problem, though. What happens if a new batch of data

happens to disagree with decades of prior research?

James O'Shaughnessy, a U.S. money manager and financial researcher,

regularly publishes new editions of What Works on Wall Street, his

mammoth and illuminating tome on by-the-numbers investing strategies.

In the earlier editions of his book, it was clear that buying stocks

with low price-to-book values was a winning strategy. Looking at

results from 1951 to 2003, stocks with low price-to-book (P/B) ratios

handily outperformed high-P/B stocks.

But Mr. O'Shaughnessy recently came out with the fourth edition of

What Works on Wall Street and now the case for a low-P/B strategy is

far less clear cut. Why? Because he added new data to the analysis to

account for recent developments and, even more significantly, the

distant past.

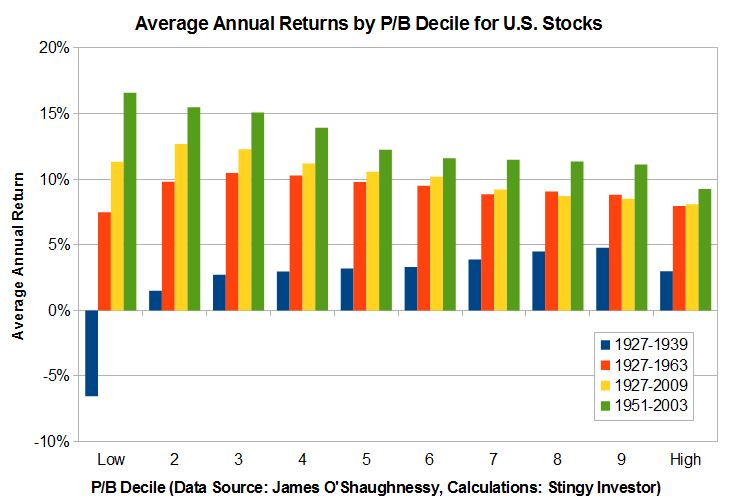

In Mr. O.Shaughnessy's studies, he sorts U.S. stocks by P/B, separates

them into 10 equal groups called deciles, tracks them for a year, and

then repeats the process. The results are shown in the accompanying

bar chart for four different periods.

[larger version]

Recall that the third edition of Mr. O.Shaughnessy's book looked at

the data from 1951 to 2003. The three series starting in 1927 come

from the latest edition of the book. As a result, we get to see the

impact of two of the biggest bear markets since the late 1920s - those

of 1929 and 2008.

Factoring in the 1929 crash, and subsequent Depression, makes a big

difference to the long-term record of low P/B stocks. During the Dirty

Thirties, these apparently cheap stocks produced miserable returns.

Imagine you started doing P/B analysis in the early 1940s and saw the

pattern of returns from 1927 to 1939. You would likely have avoided

low-P/B stocks like the plague.

The situation remained poor even during the much longer period from

1927 to 1963, just before growth investing and the Nifty Fifty became

all the rage. In this case, the lowest-P/B decile lagged the average

stock by just over 2 percentage points annually.

The lowest decile of P/B stocks eventually became a strong contender

over the very long-term. It is also important to point out that

low-P/B stocks have performed quite well since the 1930s. Indeed, the

strong performance record of the recently departed Walter Schloss, a

value investing legend, stands as a testament to the gains of such

stocks in recent decades.

But it makes one wonder just how long the long-term should be when

studying stocks. Even the 50 years from 1951 to 2003 weren't

sufficient to suss out the weakness in the lowest decile of P/B

stocks. More trouble might be revealed if the numbers are tracked back

another 25 years - or followed forward for another 25. The moral here?

Investors should strive to find evidence that disconfirms their

theories.

First published in the Globe and Mail, February 25 2012.

|

|